Why Risk Reduction Needs to Be a Key Measure to Your Organization’s Success

According to the Bureau of Labor Statistics, the "Services to Buildings and Dwellings" sector, which includes HVAC, utilities, and landscaping providers among others, has a higher incidence rate of injuries than other industries. That’s no surprise thanks to the mobile nature of the work involved.

Safety incidents can cost employers billions annually when factoring in claims, vehicle downtime, medical expenses, lost revenue, and other costs. And efficiency related risks can translate to inefficient scheduling, missed appointments, and general poor customer service experiences for customers. For businesses that do most of their work out in the field, this could mean leaving yourself open to huge areas of risk.

Leaving risk on the table is not only unsafe for your team, but costs can add up quickly. When you lower your organization’s risk, you’re proactively working to save money, help protect your employees, and maintain a stellar reputation. Let’s explore what constitutes risk in the field service category, costs related to risk, common pitfalls when considering risk management, how to effectively reduce your organization’s risk, and the benefits that come out of that effort.

Understanding risk in the field service category

For a field service technician in industries like HVAC, utilities, and landscaping, "risk" can be defined as the potential for encountering hazards that could result in injury, property damage, or financial loss during their work.

Types of risk:

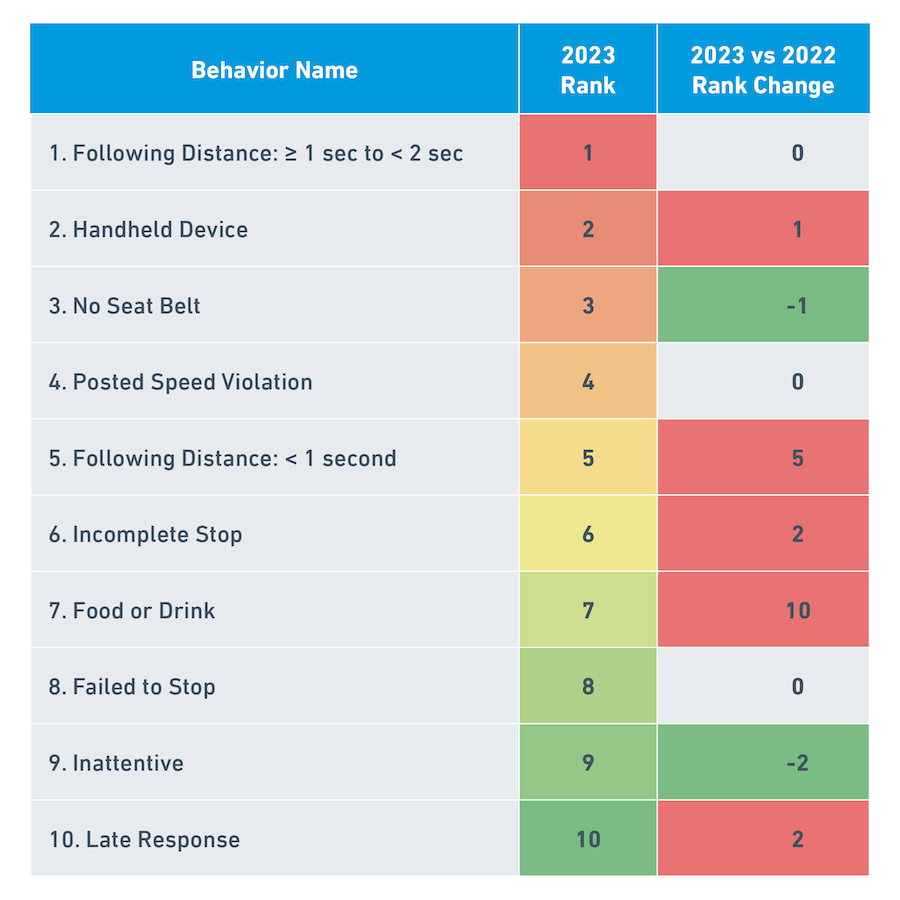

- Distracted driving: Technicians on the way to jobs may face more risk if not careful behind the wheel. According to Lytx 2024 State of the Data, hand-held device use was ranked as the second most prevalent risky behavior, up one spot from 2022.

- Vehicle damage: Expensive company vehicles may encounter risk and damage while on a job site or at a residence. This can lead to costly repairs and take valuable vehicles off the road. The National Safety Council estimates that damage to motor vehicles in work-related injuries was $5.6 billion in 2022.

- Equipment and vehicle maintenance failures: Not keeping up with routine vehicle maintenance could escalate the risk of breakdown, leading to unnecessary and costly downtime for vehicles. In fact, estimates suggest downtime can cost a fleet an average of $448 to $760 per day.

- Customer experience: As service companies grow, it can be difficult to scale operational needs with it. This can lead to growing pains of sub-optimal scheduling of service appointments, lack of efficient route planning for technicians, all of which can put your reputation at risk. In fact, 48% of customers have switched brands for better customer service according to Salesforce data.

.jpg)

The cost of ignoring risks adds up

Claims payouts, vehicle repair costs, and the harder to quantify hits to your reputation are just some of the costs associated with risk.

Insurance and liability claims costs

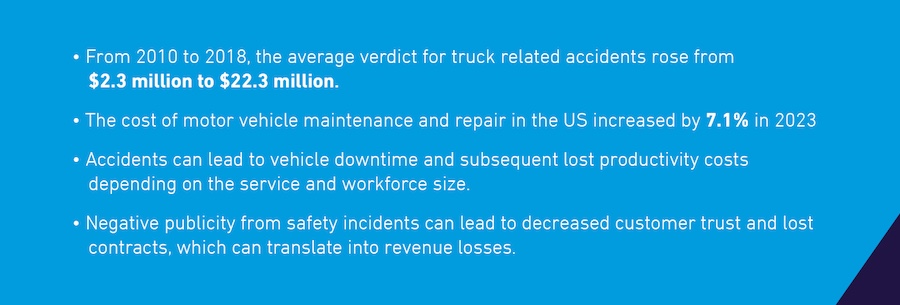

• Liability insurance premiums can increase after claims. And let’s not forget about the claim costs themselves. From 2010 to 2018, the average verdict for truck related accidents rose from $2.3 million to $22.3 million.

• Legal fees related to claims can add another layer of cost, often adding thousands of dollars per case.

• Simply stated, insurance companies are often now requiring video and safety telematics as a condition of annual insurance renewals.

Vehicle repair costs

• Costs for repairs due to accidents vary, but a single incident can range from a few hundred to several thousand dollars, depending on the severity.

• The cost of keeping vehicles maintained isn’t getting any cheaper either. According to the U.S. Department of Labor Statistics, the cost of motor vehicle maintenance and repair in the US increased by 7.1% in 2023.

Downtime costs

• Accidents can lead to vehicle downtime and subsequent lost productivity costs depending on the service and workforce size.

• When downtime occurs, operating costs increase with increased labor (overtime) and customer response (dispatch, customer service, etc.).

Reputational costs

• Negative reviews from safety incidents or missed appointments can lead to decreased customer trust and lost contracts, which can translate into revenue losses. This can be difficult to quantify but can have lasting impacts.

• The cost of rebuilding a brand after incidents like these often require substantial marketing investment and customer outreach.

Where do organizations most often fall short when it comes to addressing risk?

Field service organizations may think they have their bases covered when it comes to identifying potential risk and doing what they can to minimize it. But there’s a good chance that there’s still areas of possible risk are require a close look.

• Underestimating driving risks: Speeding, distraction, not wearing a seat belt, and following too closely continued to top the list of risky behaviors in Lytx® State of the Data report.

• Lack of real-time monitoring: Fleet tracking aids in having full visibility into your entire operation, wherever your vehicles are. Without it, you’ll be flying blind when it comes to driver routing, geofencing your vehicles and drivers, knowledge of where vehicles and equipment are, and other important aspects of running a fleet.

• Not treating safety as an integral part of your culture: Treating safety as proactive versus reactive can save time and resources across your entire organization, including areas like employee retention and lost time due to injury.

Ways to make risk reduction a key measure of success at your organization

Develop a safety program

If you don’t already have a safety program in place, you can take steps to create a system that tracks and manages safe driving. A great driver safety program typically includes the use of dash cam technology to detect and alert distracted driving paired with self-coaching and targeted coaching when needed, all netting out to huge benefits felt across your organization.

Trimac Transportation, a company of 3,400 employees who provide bulk shipping solutions across North America, shifted their culture from investigation-based to one that fostered a comprehensive safety effort with open communication and proactive efforts. This led to a 53% reduction in accidents, 42% reduction in lost time to injuries, $5M in claim cost savings, and 4.1% improvement in retention.

Beyond keeping your technicians safe, a safety program can help reduce your insurance costs, and you can even reinvest those savings in your team, like NPL Dedicated LLC did.

We really challenged ourselves, really went after the behaviors and again, in a positive way with the drivers. We focused it on training and improving...And it was so good that when it came time for renewal...we negotiated a pretty significant decrease in insurance premiums for the renewal year coming up. And the best thing about that was our ownership said, you know what? Take 60% of that and give it to all the employees. Spread it out. That was amazing. But that was the most surprising thing, just that level of success. My team has just been great.

Ongoing training and raising the bar

Creating and executing a driver safety program is a critical foundational step to lowering risk. But it doesn’t stop there. Regular training and upleveling of safe driving techniques and awareness means you’re always raising the bar for your team and continually keeping risk in check.

One way to do this is by encouraging technicians to feel empowered to take ownership of their own behavior behind the wheel. You can do this by incentivizing great driving, gamifying your program to reward safe technicians, or other creative solutions that work for your team. NPL Dedicated LLC found the best approach to be one that uses many tools and avenues to reach the team and make changes last.

“You have to have a lot of tools in the box because of the nature of the operation. The drivers are not in your office. It's not like pulling office employees into the break room for a meeting. So, we use a really multifaceted approach. We have monthly training modules, most of which we do in-house. We'll do recorded Teams meetings or voiceover PowerPoints...Some of those modules, they have to complete them every month. We do email blasts to the drivers based on current events or current weather or traffic situations. We do monthly conference calls with the drivers.”

Utilizing technology

When you leverage technology like video, GPS fleet tracking, and telematics to monitor technician driving behavior and provide real-time feedback, you’re getting a handle on risk rather than putting risk in the driver’s seat. Take Honey Bucket as an example. Their drivers are often first to receive blame when mystery damage appears at a work site. Prior to implementing video solutions in their fleet, they would have to send employees to investigate and resolve the issue. Video allowed them to reduce he-said-she-said negotiations and accelerated resolutions, saving them time, money, and maintaining their reputation.

In addition to getting visibility into accidents and damage with video, Honey Bucket used in-cab alerts to help drivers self-correct in the moment, configuring settings to their specific needs and preferences. After just six months, Honey Bucket saw a 43% decrease in traffic violations and a 40% decrease in speed policy violations.

When it comes to technology like fleet tracking with GPS, it can be a game changer for technician utilization rates, increasing billable hours, and keeping downtime to a minimum.

With the fleet tracking capabilities of the Lytx video telematics solution, Smart Care increased their fleet utilization rate from 65% to 80%. Work visits also increased from 1.8 to 2.5 per day, all equating to more billable hours, less downtime, and greater efficiencies.

How to measure risk reduction success

Your risk reduction metric can be informed by many factors. Once you start taking steps to manage your company’s risk, consider the following areas to highlight your company risk reduction and help you set a KPI or goal.

- Safety incidents: How many incidents occurred compared to previous years?

- Behavior changes and coaching needs: How much did your technician’s driving behaviors or coaching needs change?

- Insurance and liability costs: How much did your insurance and liability costs change?

- Vehicle downtime: How much vehicle uptime time was gained due to proactive vehicle maintenance?

- Employee retention: How did your employee retention rate fluctuate?

- Vehicle loss: Did you lose any vehicles to theft or technician negligence?

- Company reputation: Did your company experience any change in reputation, through reviews, rankings, or other measure?

Safety is a highly competitive business advantage when companies expect, seek and manage to eliminate unsafe behaviors and conditions. Today’s best companies do this well, realizing there is not championship or any single defining moment, but rather an endless pursuit of eliminating all risk.

It’s not easy to wrangle risk when it comes to managing a fleet of vehicles out in the field with technicians behind the wheel every day. Through the right mix of technology, technician training, and cultural shifts to be more focused on proactive safety, your organization can not only get a grip on all its risky areas but can begin to make meaningful strides to reduce that risk. All that’s left for you to do is reap the rewards.

Learn more about Lytx’s Driver Safety Program, Fleet Tracking, or read more on the latest trends and insights around fleet management!